26+ dti required for mortgage

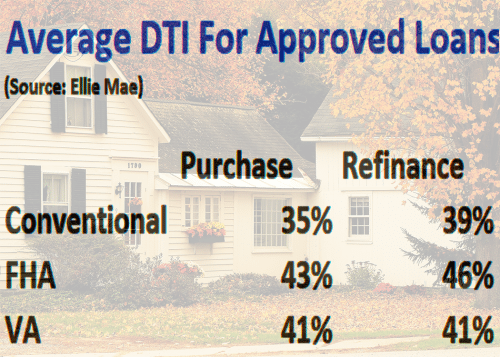

Web Debt-to-income ratio. Up to 43 typically allowed 36 is ideal FHA loan.

Debt To Income Ratio Dti What It Is And How To Calculate It

USDA loans look at two different types of DTI.

. Why Rent When You Could Own. The maximum front-end DTI is 29 this is the percentage of your gross. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Ad Tired of Renting. Ad Select Your Perfect Loan And Get Started Today. Its Never Been Easier.

Lower your monthly debt obligations Temporarily prioritize debt. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Best for borrower education.

Web You can follow these tips to lower your DTI and improve your chances of mortgage approval. Best for on-time closing. With a Low Down Payment Option You Could Buy Your Own Home.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Get Home Faster With MT. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial health.

Web Calculating your debt-to-income ratio for mortgage loans is easy. Ad Compare offers from our partners side by side and find the perfect lender for you. With a Low Down Payment Option You Could Buy Your Own Home.

Best for a fully online process. You pay 1900 a month for your rent or mortgage 400 for your car. Ad Compare Top Mortgage Lenders 2023.

Its Never Been Easier. Ad Select Your Perfect Loan And Get Started Today. Get Started On Your Application Online And Be On Your Way.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Debt-to-income ratio your monthly debt payments divided by your gross monthly income. Get Home Faster With MT.

Your lender will also look at your total debts which. Web Your lenders maximum DTI limit will depend partly on the type of loan you choose. Just add up what you owe and compare it to your income and youll figure out this important number.

Web Bank of America. Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Ideally lenders prefer a debt-to-income ratio lower.

Calculating your DTI 1 may help you determine how. Get Started On Your Application Online And Be On Your Way.

What Debt To Income Ratio I Need To Buy A Home Big Block Realty

Jessica B Bilingual Mortgage Loan Officer Colorado Greenwood Village Co

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What S A Good Debt To Income Ratio For A Mortgage

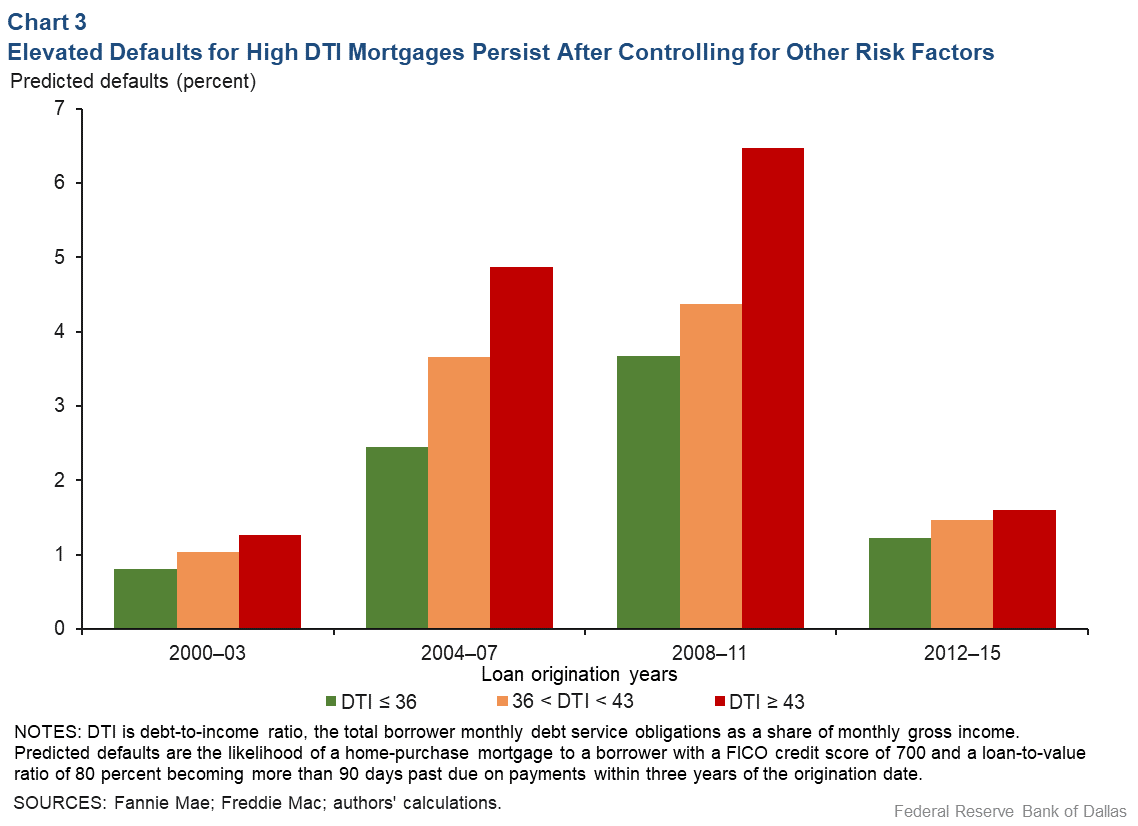

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Dti Ratio Calculation Formula Limitations And Types

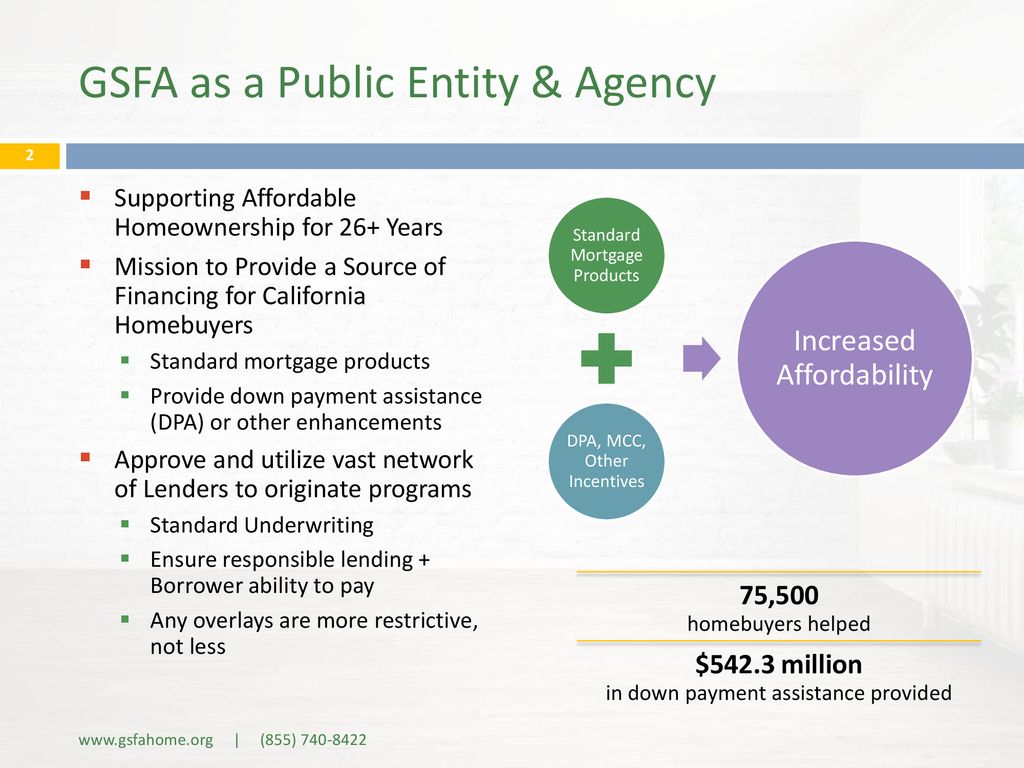

Home Ownership Today Hot Ppt Download

Debt To Income Dti Ratio Requirements For A Mortgage

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Regulator Ends Debt Ratio Standard For Mortgage Approvals Orange County Register

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

Debt To Income Ratio Loan Pronto

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

How Do I Know That I Ll Be Approved For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Understanding Dti Debt To Income Ratio Home Loans